Whether you wish to secure your financial future by establishing a regular savings scheme or invest a lump sum you have accumulated to generate income or provide growth on the capital, Entrust International has an extensive range of products to select from.

- For regular savings, capital protected products are available over a range of different terms, leaving you secure in the knowledge that a guaranteed, minimum return will come back to you, at the same time giving you enhanced growth prospects based on market performance.

- For lump sum investments, an extensive range of products are available, some with capital guarantees and income. Also available is a range of rated and listed corporate bonds with high income payments and principle protected, equity linked products, so securing the capital but giving future growth potential on the amount invested. Whatever your objectives, we have the solution for you. A selection of some of our attractive investments is detailed below.

Fixed Income Bond

3-Year Fixed Income Bond 14% pa. Minimum Investment 50,000 (GBP/EUR/USD) – Ideal for clients who want high security with a great return, without locking their money up long term. Income paid quarterly with penalty free redemption available on each anniversary. Listed 5-Year term and Shariah compliant versions also available. Learn more

Urban Village Property

Urban Village Property Bond 9.6% pa. Minimum Investment, 25,000 (GBP/USD), 5-year term. Assets secured against existing property. Income paid quarterly with penalty free redemption available on each anniversary. Urban Village have a proven track record of delivering high quality developments across the private rental, office, student accommodation and care sectors.Having repaid £241,000,000 student accommodation and care sectors.Having repaid £241,000,000 ($334,956,500) funding to investors over the last seven years we are proud to be able to present the Urban Village Cap 1 Ltd Annual Access Bond. Learn more

A-rated, listed, 9% Senior Secured, Investment Grade bond. USD version matures 19th December 2023, GBP version 15th July 2025. Quarterly coupon payment. Linklease (‘LL”) is an operating lease Company who serves SMEs across the MENA region with traditional sources of equipment finance. LL cater to a broad range of industries including healthcare, logistics, manufacturing, printing and construction to name just a few With over 25 years of specialist experience in SME asset-based financing, the team has delivered deals to the tune of $USD1 billion across more than 3,500 transactions. Learn more

Neutral Capital Finance Plc 7.25% due 2026 (Matures April 2026). Listed, Senior secured debt, USD denominated with income paid semi-annually. Neutral Fuels is the largest producer of biofuel in the Gulf region. The company operates from recycling facilities in Dubai, Abu Dhabi, Bahrain, and Delhi serving customers such as McDonald’s, Nestlé, PepsiCo, Del Monte, Emirates Airline, ENOC, ADNOC, IKEA and many others. Learn more

Listed, 2024 secured bond paying 8% per annum on a quarterly basis. GBP/USD denominated. Zenzic Capital (“Zenzic”) is an independent investment bank that both advises and invests in structured finance transactions across asset-backed industries. Since 2015, Zenzic has advised on >$2.8bn of asset-backed transactions across more than 70 individual mandates and 10 investment sectors. Learn more.

Blockchain Strategies Fund SCSp (Luxembourg) is the world’s first fund of funds focusing on blockchain technology investment opportunities such as Funds focusing on all aspects of digital currencies and listed companies using blockchain technology. The Fund has been designed to offer investors full access to the world’s newest and fastest growing asset class with the benefits of sound risk management and portfolio diversification to reduce volatility. Learn more.

Scotch Whisky casks have proven to be an excellent alternative investment. As a tangible asset, it offers financial security and the nature of whisky means that it rises in value as it matures in the cask. Historically, Scotch Whisky casks have delivered average returns of circa 12.3% pa over the last decade and are amongst the safest and most secure assets you can hold. Investors may purchase Casks of Scotch Whisky at £2,200 each which will then be placed into an HMRC approved bonded warehouse on site at the distillery, and held for a minimum of 3 years, being the time required for maturation of the raw spirit to officially be classified as “whisky”. After 3 years, it can then be sold at a much increased price or held for longer in anticipation of further increases in value. Learn more

Personal Financial Planning

Compound Growth

The ultimate equalizer compound growth will relentlessly work for you It’s about discipline and time and is a tool that works for you regardless of who you are.

WHY IT’S IMPORTANT TO SAVE NOW

What makes compound growth work best is time. An investment left untouched for a long period can add up to a large sum. A simple example, based on compound interest follows: –

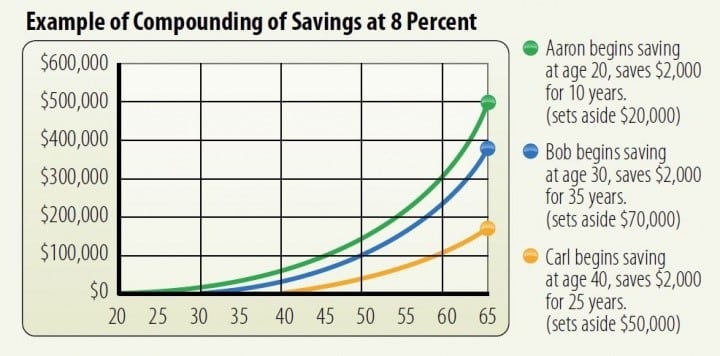

In this scenario Aaron Starts to save for retirement at age 20 at the rate of $2,000 per year but saves only for 10 years. Carl doesn’t begin until he is age 40 and invests $2,000 each year until he reaches age 65. Bob begins saving at 30 and contributes $2,000 each year until age 65. Neither of the last two will have as much at retirement as Aaron, thanks to the power of compounding.

Assuming a growth rate of 8 percent each year, as the chart above shows, both Bob and Carl will contribute considerably more than Aaron but will end up with about $100,000 to $300,000 less at age 65—Aaron also can stop contributing at age 30. The reason is the power of compounding. It pays to begin saving early.

Contact us to put your financial plan in place now and secure your financial future. Book a free consultation !